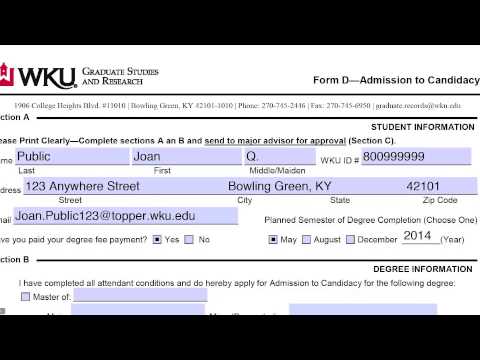

P>Hello and welcome to the video describing how to complete the form d admission to candidacy there are five things you will want to make sure of before you complete your form d first you need to have a three point and all courses listed in your degree program or form bc and your overall graduate GPA second you need to have completed the research tool or the foreign language requirement is specified by the program third you need to have your program of study also known as your forum bc on file with the graduate school forth you will need to complete it at least 15 hours of your program finally you need to complete it all of your deficiencies listed on your program study with a grade of C or better once you've completed these items you are cleared to complete and fill out the form to begin open up the form in Adobe Reader or Adobe Acrobat this is especially important if you are working on a Mac computer start by filling in your last and first name and then your student identification or 800 number with or without dashes fill out your current address if you have a local address it would be better to put that one on this form when completing the form be sure to put your WSU email address this is where all correspondence regarding this form will be sent once you have your WSU email address in the form please check off if you have paid your degree fee payment this is the fee you pay to graduate and also lets us know that you are ready for us to check whether you have completed all of your requirements for your program while it is not necessary to pay your fee...

PDF editing your way

Complete or edit your ds 160 form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form visa us directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your ds 160 application as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your ds 160 form pdf by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form DS-160

About Form DS-160

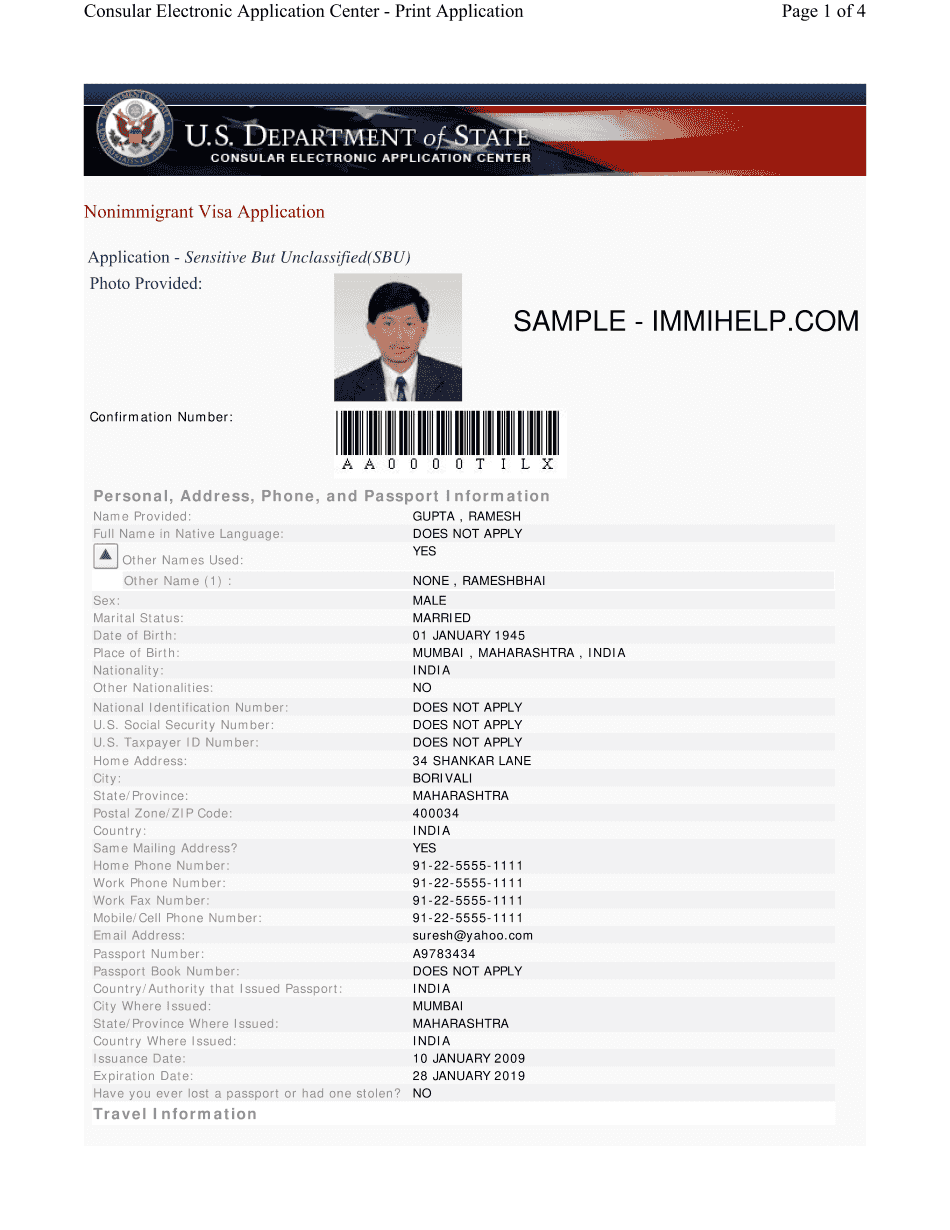

Form DS-160, also known as the Online Nonimmigrant Visa Application, is a document required by the United States Department of State for individuals seeking nonimmigrant visas to enter the United States temporarily. It is an electronic application form that must be completed and submitted online by applicants. The DS-160 is applicable for various categories of nonimmigrant visas, including tourism, business, study, temporary work, medical treatment, or any other temporary visit for specific purposes. It is essential for individuals who are planning to travel to the United States and do not qualify for visa-free travel under the Visa Waiver Program. Whether you are applying for a visitor visa (B1/B2 visa), student visa (F1 visa), work visa (H1B visa), or any other nonimmigrant visa category, the DS-160 form is typically mandatory. It allows the U.S. Consular officers to evaluate the eligibility of visa applicants and determine if they meet the requirements for temporary travel to the United States. It is important to note that each individual planning to visit the U.S. must submit a separate DS-160 application, regardless of whether they are traveling alone or with family members. It must be completed accurately, providing truthful and detailed information about personal and travel-related matters. After completing the DS-160 form and submitting it, applicants are required to schedule an interview at the U.S. embassy or consulate in their country of residence. The consular officer will review the application and conduct the interview to further assess the applicant's eligibility for the desired nonimmigrant visa.

What Is Ds 160 Form?

Today more and more people desire to get the U.S. visa for number of purposes. In order to get a visa each applicant is required to fill out an application form. A form DS-160 is a document which lets individuals apply for nonimmigrant temporary visas to the United States, including those for tourism, temporary employment or studying etc.

Such application is usually prepared and submitted electronically and doesn`t require any additional forms. On our site you will find a blank ds 160 form sample which can be easily filled out and submitted online. All you need is just to follow the specified instructions.

The document consists of two pages which includes questions and fillable fields for answers. It is important to answer all required questions accurately and completely as well as fill in all empty fields in order to avoid any delays or rejections.

An applicant has to prthe following information in a fillable form:

- personal details including name, address, date and place of birth, nationality etc;

- information regarding his/her passport;

- the reason for obtaining a visa;

- date of arrival to the U.S.;

- dates of your last arrivals to the U.S. (if any);

- other details about a trip;

- signature and date of preparing a form.

It is necessary to insert an applicant`s photo in a document. For this a person has to upload his/her digital photo. You can easily edit a form in PDF using our tools. After a document is completed, it is necessary to check it for mistakes and sufficiency of information in order DS-160 form to be approved.

Submitting a document electronically is not the last step in a visa applying procedure. Once a form is submitted, an applicant may be asked to come for an interview to the embassy or consulate.

Online methods make it easier to prepare your document management and supercharge the productiveness of your workflow. Observe the short information to be able to full Form DS-160, refrain from errors and furnish it in a very timely fashion:

How to complete a Ds 160 Blank Form Download Pdf?

- On the website while using the type, click on Initiate Now and move to your editor.

- Use the clues to complete the related fields.

- Include your own facts and phone data.

- Make convinced that you enter suitable facts and numbers in suitable fields.

- Carefully verify the subject matter from the kind also as grammar and spelling.

- Refer to assist segment when you've got any concerns or address our Service team.

- Put an digital signature with your Form DS-160 with the support of Indication Tool.

- Once the shape is accomplished, push Completed.

- Distribute the prepared sort through e-mail or fax, print it out or help you save on your equipment.

PDF editor will allow you to make adjustments to the Form DS-160 from any online world connected gadget, customize it in accordance with your preferences, sign it electronically and distribute in different approaches.

What people say about us

It's a smart idea to submit forms on-line

Video instructions and help with filling out and completing Form DS-160