In this video, we're going to go over session timeouts. In order to maintain security and PCI compliance, we have updated our session timeout to 15 minutes. The session timeout will only affect those who are logged into the account and are idle for 15 minutes. If this happens, you will need to log in again to resume your session. This session timeout only applies to the admin console user interface and is implemented for security reasons. However, professional and enterprise level accounts have the ability to bypass this requirement. To do so, go to the security tab in the admin console. To access the security tab, navigate to the admin console and click on the security tab. Scroll down until you find the session timeout setting. From here, you can set the session timeout to any amount of hours or minutes. Please note that the minimum session timeout is 5 minutes and the maximum is 24 hours. Remember that this feature is only available for professional and enterprise accounts in the admin console. For additional support, you can refer to the support articles located at support.dotfilesanywhere.com. Specifically, under the promoted articles section, you will find the session timeout article. This article provides detailed information about the session timeout feature, as well as answers to common questions. If you have any further inquiries that are not covered in the article, please feel free to contact us at 1-888-661-6565 or send us an email at support@filesinyourcomm. Thank you.

Award-winning PDF software

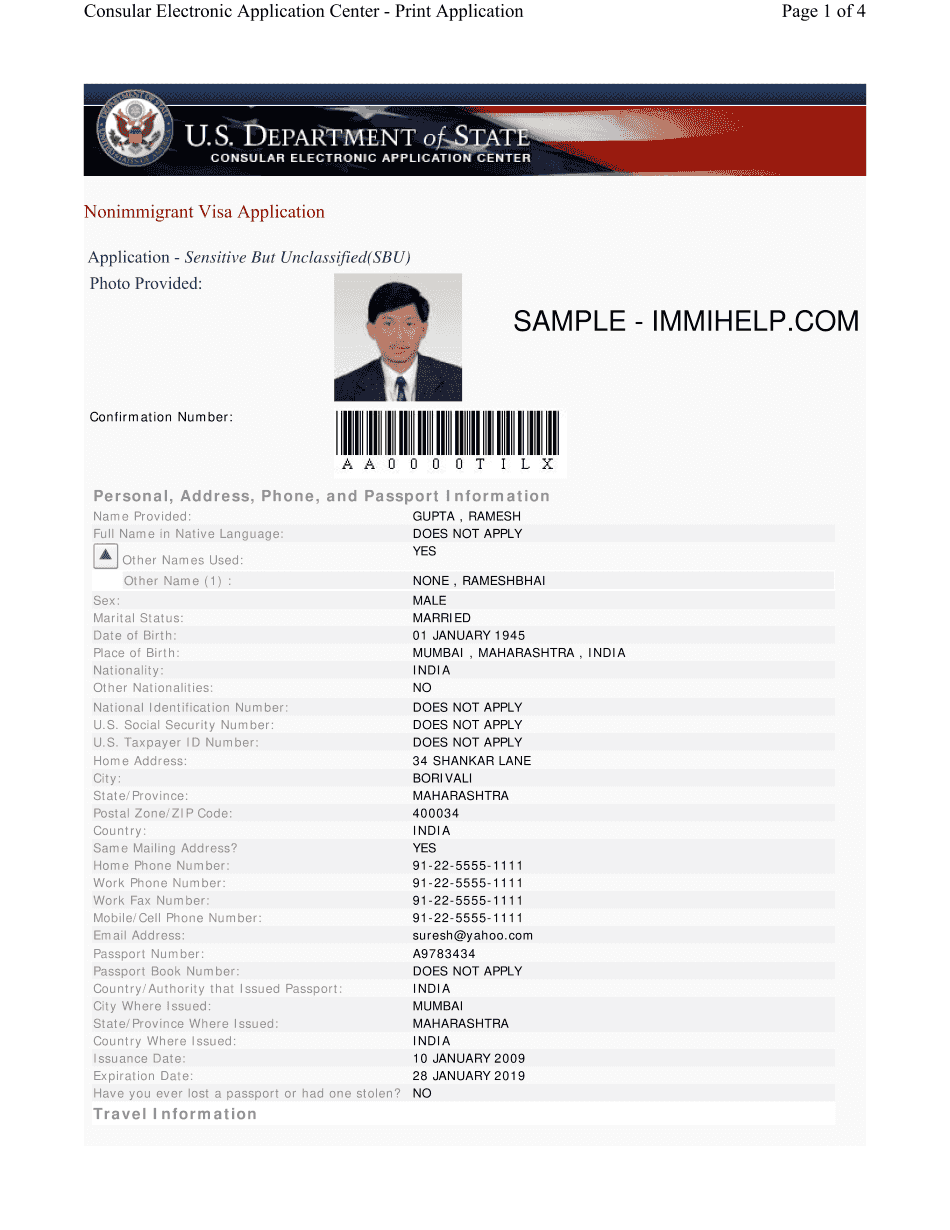

Ds 160 session timed out Form: What You Should Know

It will upload the documents that are needed to complete your tax return and automatically fill in the amount and date of payment. This means you can pay by mail, have Turbo take care of the tax forms, so you can focus on your report. This makes your tax return more complete and efficient. If you pay by check, the amount can be added to the income tax liability at the end of the year. How To Sign Turbo Tax Form 3520 Sign Turbo Tax Form 3520 by hand or by computer. Do not print it. TurboT ax will email you instructions when you have to sign the form. If you prefer to sign electronically, TurboT ax has a Turbo Tax computer application for mobile devices, tablets, and laptops. Sign by using TurboT ax Form 3520. It will scan the form, create a PDF, and create a digital signature for you. Download Form 3520 | Fillable PDF If you have specific questions, TurboT ax provides the following resources. How to File a Paper Tax Return on TurboT ax File a Tax Return The Turboprop Turbo Tax service can file paper tax returns. The following instructions are for those filing by mail or using Turbo Tax for the first time. The IRS will not charge interest on the tax you owe. If you owe taxes, contact one of the following entities: Internal Revenue Service Telephone: TTY — TTY is a public access number to TTY services, used to get help from a commercial telephone operator for disabilities. Telephone: TTY — TTY is a commercial dial-up connection service, used to be able to get help from a commercial telephone operator for disabilities. If you have difficulties using TurboT ax's interactive feature, please use TurboT ax's live online tax service. Do not use “Tax and Deductions” for your tax return. See How to file. File a Paper-Only Tax Return if You Are a Business If you don't use TurboT ax, but use some form of electronic filing such as Form 1040X, get the free tax preparation software that makes it easy to file a simple return online. It will do all the work for you. Form 1040X TurboT ax Alternative Minimum Tax Form 1040X Alternative Minimum Tax is an alternative tax, that you and all related parties pay if you claim certain tax deductions or credits. This year, the IRS eliminated several of the deductions and credits it offered.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form DS-160, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form DS-160 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form DS-160 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form DS-160 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ds 160 session timed out